Scale and Grow

ASICS Runkeeper App

Workshop

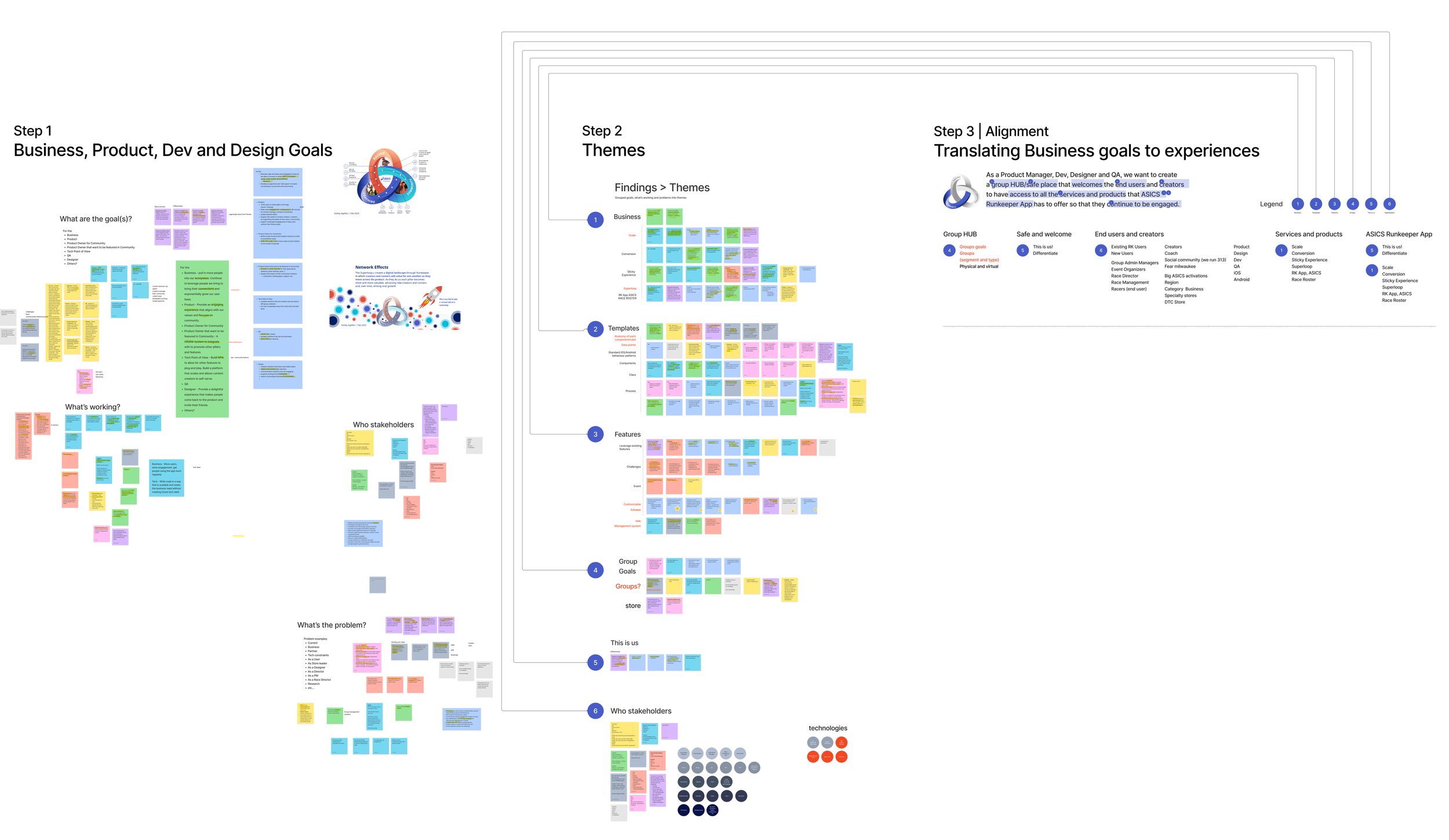

I conducted a workshop with all the stakeholders to share their inputs on Clara Henry's Group to discuss the areas of improvement and opportunities for the 'Group' next release —all stakeholders' inputs matter so that there is alignment on the problem(s) we need to solve.

Stakeholders that attended the workshop

Product

Director of Product Manager

Community | Senior Product Manager

Challenges | Senior Product Manager

Development

Principal Application Architect

iOS Developer

Android Developer

QA

Design

Principal UX Architect

UX Manager

Community | Senior Designer

Step 1

Business, Product, Dev and Design Goals and Pain Points

The Clara Group Project happened so quickly that we wanted to hear what the team was thinking and understanding of a new user segment, the 'Creator.'

A creator is a B2B user segment that provides their products or services to the athletes.

An athlete is a B2C user segment that participates in any activity in the ASICS Runkeeper App.

-

Asked the team what are the goals for the:

Business

Product

Product Owner for Community

Product Owner that wants their product or service featured in the Community Group Screen

Tech Point of View

QA

Designer

Others?

-

I had the team fill in their sticky notes on what's working, from processes, discovery, creation, and development to production.

-

I had the team fill in sticky notes on what was not working for themselves, the team, process, product or service.

-

B2B : Creaators

Coaches

ASICS Front runners

Influencers

Ambassadors

ASICS Community Stores

Social Community leaders (e.g. We Run 313, FEAR Milwaukee)

Event organizers

DTC Stores

Run Specialty Stores

Big ASICS activations driven by Region/Category Businesses

B2C : Athletes

Anyone who moves from walking, hiking, running, swimming, cycling, meditating, etc,

Training

Racing

Joining groups, events and challenges

Step 2

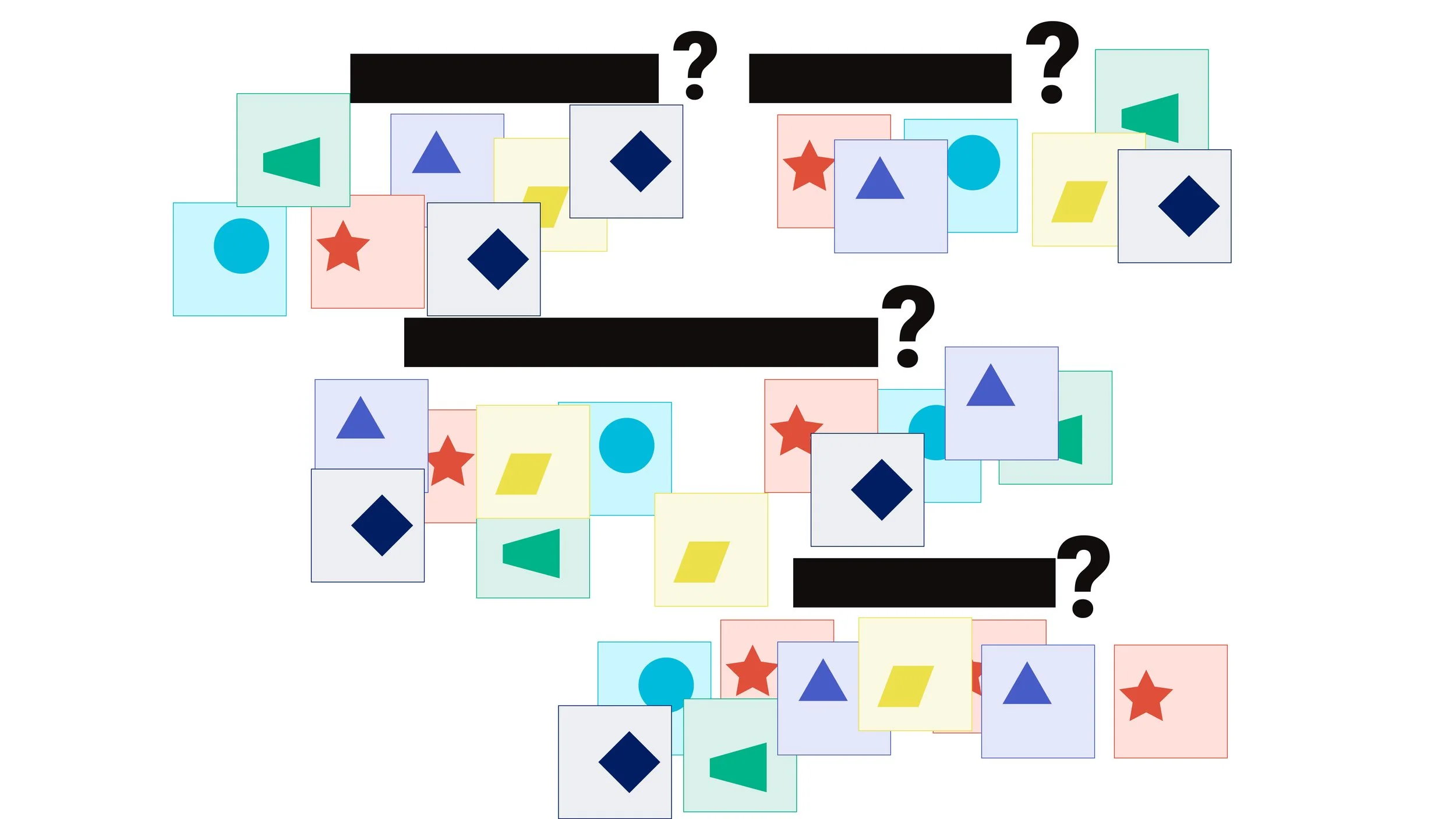

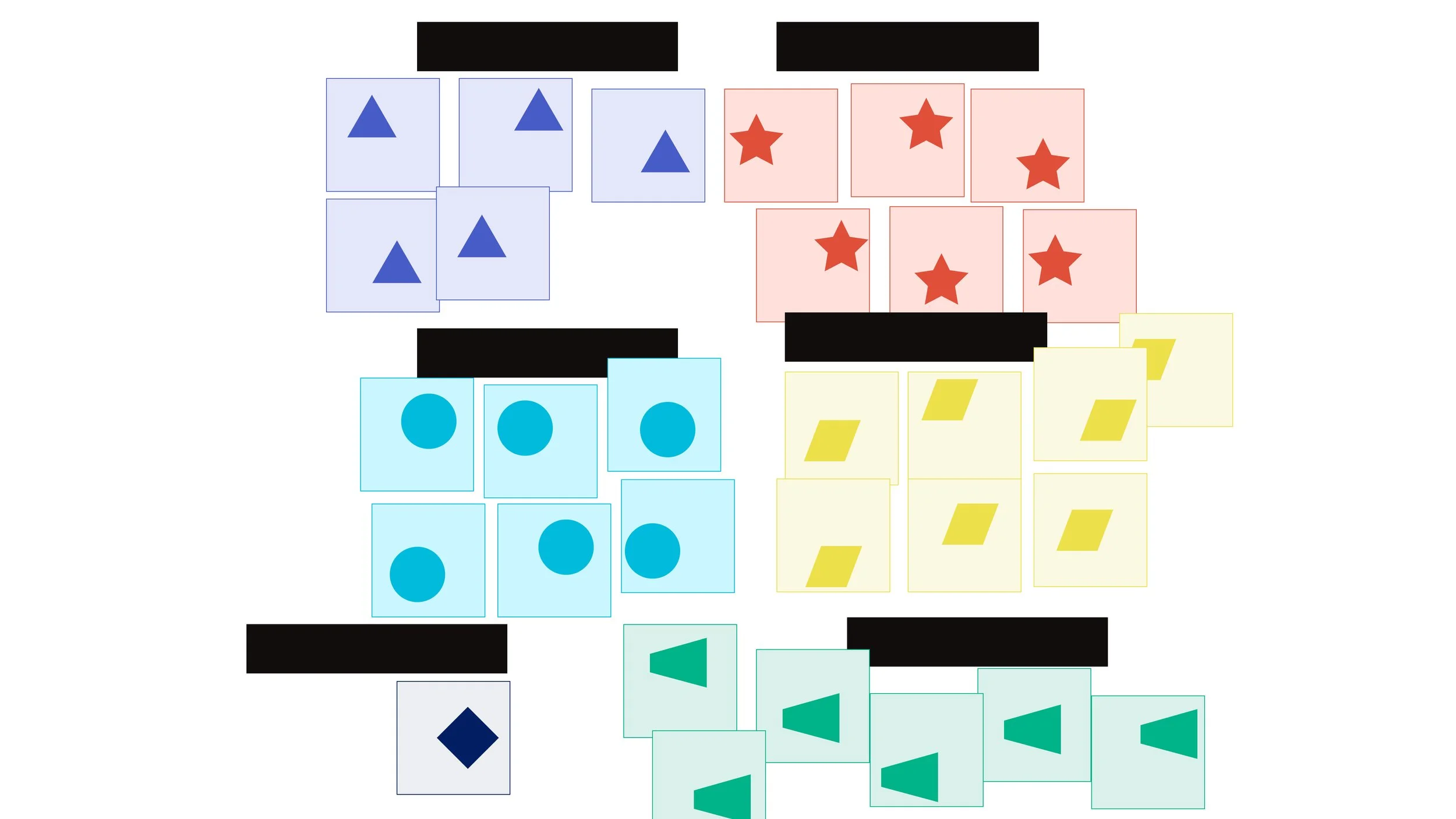

Grouped keywords into themes

All the stickies had keywords; I highlighted them on each sticky note and grouped them into themes.

-

Business themes:

Scale

Conversion

Sticky Experience

Superloop

RK App, ASICS, Race Roster

-

Template themes:

Anatomy of each card/component

Data points

Standard iOS/Android, pattern and behaviours

Components

Clara (Influencer

Process

-

Feature themes:

Leverage existing features

Challenges

Event

Customizable

Editable

Web

Management system

-

Group themes:

Group

Group goals

In-store groups

Create a group vs Groups

-

“This is us’ theme:

Differentiate

-

Internal | Employees

Product

Design

Dev

QA

Marketing

Race Roster

ASICS as a whole

etc

B2B: Creators

Coaches

ASICS Front runners

Influencers

Ambassadors

ASICS Community Stores

Social Community leaders (e.g. We Run 313, FEAR Milwaukee)

Event organizers

DTC Stores

Run Specialty Stores

Big ASICS activations driven by Region/Category Businesses

B2C: Athletes

Anyone who moves from walking, hiking, running, swimming, cycling, meditating, etc,

Training

Racing

Joining groups, events and challenges

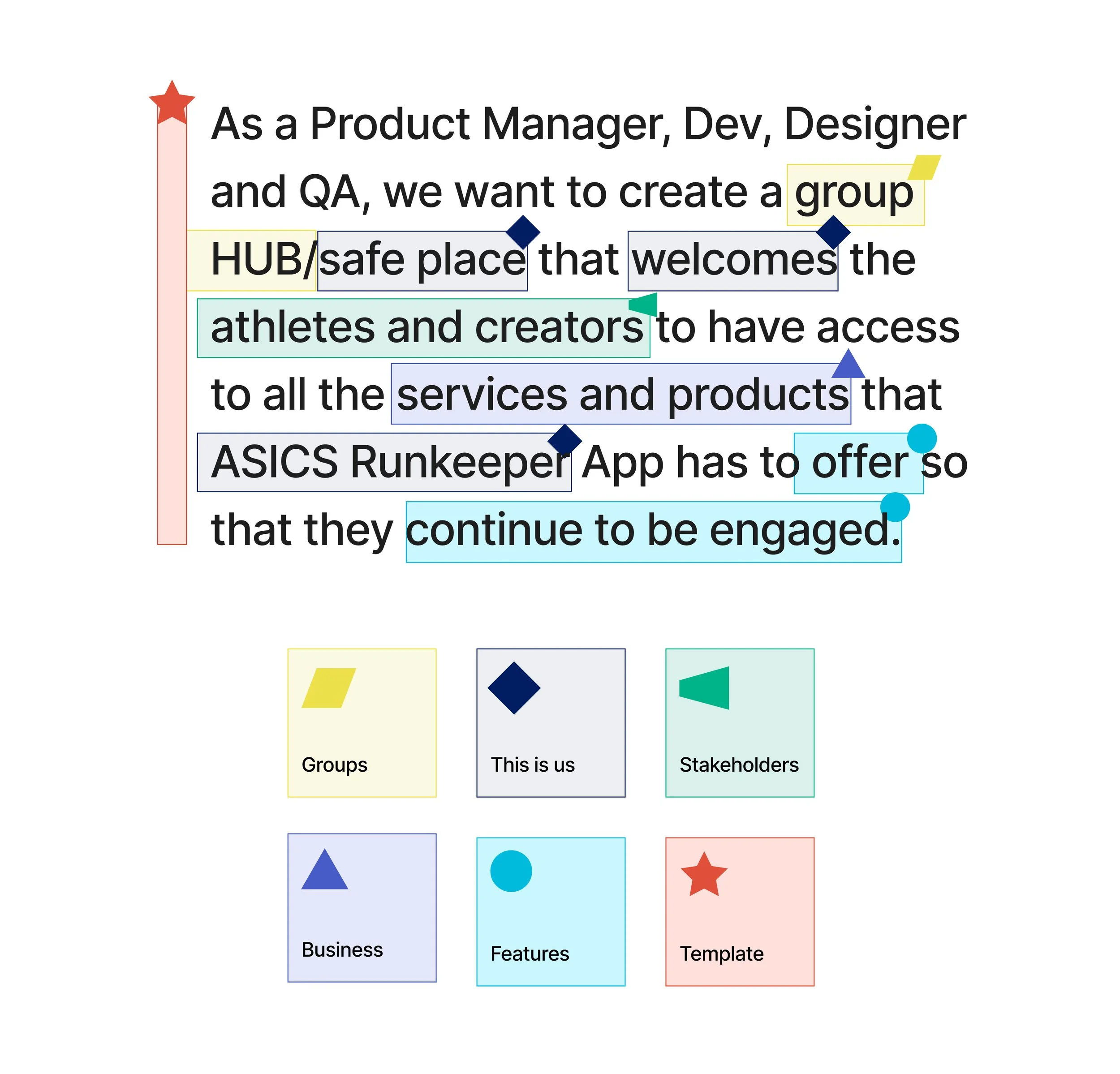

Step 3

Alignment | Translating Business goals to experiences

I summarized the business, product, development, and design goals/pain points from the highlighted keywords and themes on the sticky notes to solve problems and find solutions for the business to grow and have the best experience in the Community workstream.

Below is an image of the Figma Jam board that the team used during the workshop.

11 taps / 7 screens

to view sub-category products

Please…I just want yoga pants.

Purchase flow

The journey ends quickly.

Analyze web navigation

The web data is shared with the lululemon app and I wanted to analyze the web navigation.

In-store observation

What’s new

New items are displayed at the front of the store

Scannable

Able to quickly scan categories by groups

Discounts

At glance, no discounts viewable

Educator(s)

Welcoming

Approachable

”What are you looking for”

Guest(s)

Hears the voice of an educator

guidance readily available

All items are at their finger tips

Vision

Have the same in-store experience to digital in-store experience. Omni experience will feel seamless

In-store/online shopping journey

Aha, moment… 1 hanger away - 1 tap away

Competitors

Nike

Madewell

Best Buy

Walmart

Adidas

Oysho

Indigo

Home Depot

Puma

Aritzia

REI

La Senza

MEC

Amazon

JCrew

Target

Sources

lululemon brand

lululemon guidelines

iOS (HIG)

Android (Material design)

Baymard

Nielsen Norman Group

Dribble

Summary of findings and recommendations

Capture screenshots: current state

Finding: Browsing is confusing and difficult,

Recommendation: Gather all the data points.

User flow

Finding: The journey ends quickly. The guest is not able to get to categories.

Recommendation: Review competitors and sources.

Analyze web navigation

Finding: Categories are mixed with the main nav and category list, which makes it difficult to scan and causes confusion.

Recommendation: Group data points - by gender, category, and collection.

In-store observation

Finding: Understand the store layout. Hear the voice of an educator and guest.

Recommendation: Have the digital experience be the same as the in-store experience.

Guest shopping journey

Finding: A product is only “1 hanger away” to a fitting room.

Recommendation: Have a product 1 tap away to a category screen.

Competitive analysis

Finding: Compare commonalities, interactions and patterns.

Recommendation: Keep the commonalities, interactions and patterns that work for the lululemon brand and app.

iOS / Android patterns

Finding: The android app uses the iOS interaction and pattern behaviours.

Recommendation: Have different designs for iOS and Android.

Review with the team

Findings: Share findings with the team.

Recommendations: Create a wireframe/mockup with recommendations.

Next step

Once I get the thumbs up from the PM. I start designing high-fidelity mocks.

Data points

Group commonalities.

The solution architect, iOS, Android developers, QA and PM were involved to provide their insights from the findings and recommendations. I also, wanted to make sure the data points were right. So, that I can start on my design.

(1) Gender tab; (2) What’s new; (3) Categories; (4) Activities / Collections; (5) We made too much

1, 2 and 3 is the whole store inventory

at the tip of your fingers

Wireframe with data points

Product design solutions

Android

iOS

In-store experience to digital experience

The entire store inventory is scannable with seconds.

At the tip of your fingers the guest can browse or start shopping

Ease of use

Combined 7 screens to 1 screen to select a category

Removed 11 taps to 1 tap away to a category

Scalable

Card components scales from B2C to B2B apps

NO MORE masking images

Flexible

Components are customizable

Able to create variants

Optional: image

Optional: loopable video 6-11 seconds

Reusable

Code

Able to use the components in different features

Performance metrics

Task success

The most widely used performance metric. It measures how effectively users are able to complete a given set of tasks.

Time on task

A common performance metric that measures how much time is required to complete a task.

Errors

Reflect the mistakes made during a task. Errors can be useful in pointing out particularly confusing or misleading parts of an interface.

Effeciency

Can be assessed by examining the amount of effort a user expends to complete a task, such as the number of clicks in a website or the number of button presses on a mobile phone.

Learnability

A way to measure how performance improves or fails to improve over time.

2018

$105 M

0.59M MAU

2019 RE-SKIN: Lululemon brand changed their colours from gold to red highlights, black text and white background.

$160 M

0.82M MAU

2020 New brand guidelines and a new category UX/UI interaction

$320 M

1.32M MAU

App & web comparison case study 2020

Goal

To gather feedback from Guests that use APP primarily on the web experience and Guest that primarily use Web on the APP Experience.

Having the Guests complete simpler tasks and answer similar questions to better understand what the differences are and how they are perceived.

App & web comparison case study 2020

Overall

Web-users were more impressed with the APP and stated that they could be more tempted to use it in the future. While the majority of APP users that went through the Web experience stated that they would still primarily use the APP. The Web users felt that the APP was obvious a more tailored experience for mobile use, that the design created a more focused experience and that there was less clutter which made the experience as one participant stated, “more chill.”

The APP users did state that they do use the web sometimes, but infrequently. They did feel that the filters in the web were more robust and made finding a product easier and that the main menu had more of a story than the one on APP, but it was simpler to just click on the APP to begin their shopping experience and being automatically logged in.

Shop anywhere and anytime!

View more cases